Medical costs have been rising for

a long time now, especially since the Malaysian government has allowed

medical and dental practitioners to hike their own professional fees up to 14.4%.

Treatment that currently costs you RM10,000 will likely be quadrupled

in the next 8 to 10 years. While money tucked away in a savings account

or long-term fixed deposit might help pay for your future medical bills,

it's becoming obvious that it may not be enough. For once your savings

pools runs dry, your next option is to depend on a Critical Illness

Insurance plan.

A Critical Illness (CI) plan will provide financial support when you are diagnosed with any of the 36 critical illnesses most prevalent among Malaysians. It will be a lump sum payment based on the severity level of your ailment. For example, if your buy a CI plan with sum assured of RM30,000, 25% of that amount will be payable once you are diagnosed with early stage cancer.

However, if you are diagnosed for it at a later stage of the illness, you will be able to receive 50% of the sum assured. Because the money goes straight to you, the policyholder, you can spend it on anything at all - that would include buying yourself a holiday or a brand new sports car, but of course, the most sensible thing to do is to use the money to pay for any medical treatment and daily expenses.

But isn't that the same thing as a Medical Card? No. Unlike a CI policy, your Medical Card is an insurance plan that will only pay for the cost of your medical treatment and surgery at selected panel hospitals. These expenses are paid directly to the hospital from your insurer, not to you. If you pay for your medical bills first, you will be able to claim from the insurance company at a later date.

What illnesses should Malaysians worry about?

It is about time we lay down some

hard hitting facts and figures. We Malaysians are very generous with our

sugar, from our colourful kuihs to our super sweet teh tariks, so

there's no wonder that we are the top Asean country with the most diabetics. It is estimated that in 2011, 15.2% of adults were diabetic - that's more than 4 million people!

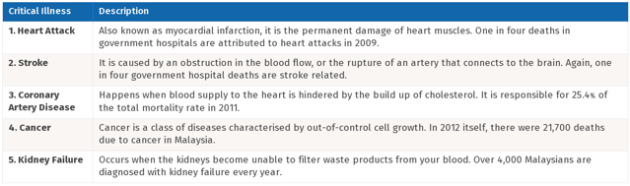

Below are the top 5 chronic diseases in Malaysia:

Typically, if you are diagnosed for a critical illness in its early stages, or below a certain severity level, you may not be able to make a claim at all. Also, traditional CI policies will end after a single claim is made.

How much do I have to pay to be insured for Critical Illness?

A better question would be, "How much can you afford to be insured for?". The amount you want to be assured for, or sum assured as it is often called, hinges entirely on your own budget and needs. The first thing to get down is calculating all the direct costs that you and your family would have to bear, and for how long.

'

Being unable to work, losing out on paid employment, and constantly commuting between your home and the hospital for daily treatment and medical check-ups is nobody's idea of living a normal life. - you will need some sort of financial support to replace your monthly income and adjust to your new lifestyle.

Here's an example:

Diana earns RM40000 a year, so the ideal amount to be insured for is at least three times her annual income, or RM120000. Her policy premium would then be around RM4000 a year, not exceeding 10% of her annual income. Remember, premiums will also depend on your gender, occupation, health condition, and your status as a smoker or non-smoker.

Why three times her annual salary? It's not as random as you think. Let's say that Diana were to suffer from cancer or fall into a coma for a prolonged period, being insured for three years worth of income would be ample time for her family to regain their footing and reshuffle their finances to fit the dramatic life change .

It is worth paying for?

When you're still young and fit - with a great family health record to boot - it's hard to imagine being bed-ridden in the hospital with a severe illness. But reality is, the older you are, the less control you have over your body. So will you be ready for that possibility?

If you think you and your family may not have enough savings to fall back on, a Critical Illness Insurance can help fill in the gaps. But remember, a good insurance plan is one that you can afford to pay. So if you have the extra cash, take up an Investment-linked CI policy, where you invest a portion of your premiums in a fund of your choice to help you save up for retirement.

Source: RinggitPlus.com